unemployment tax refund tracker

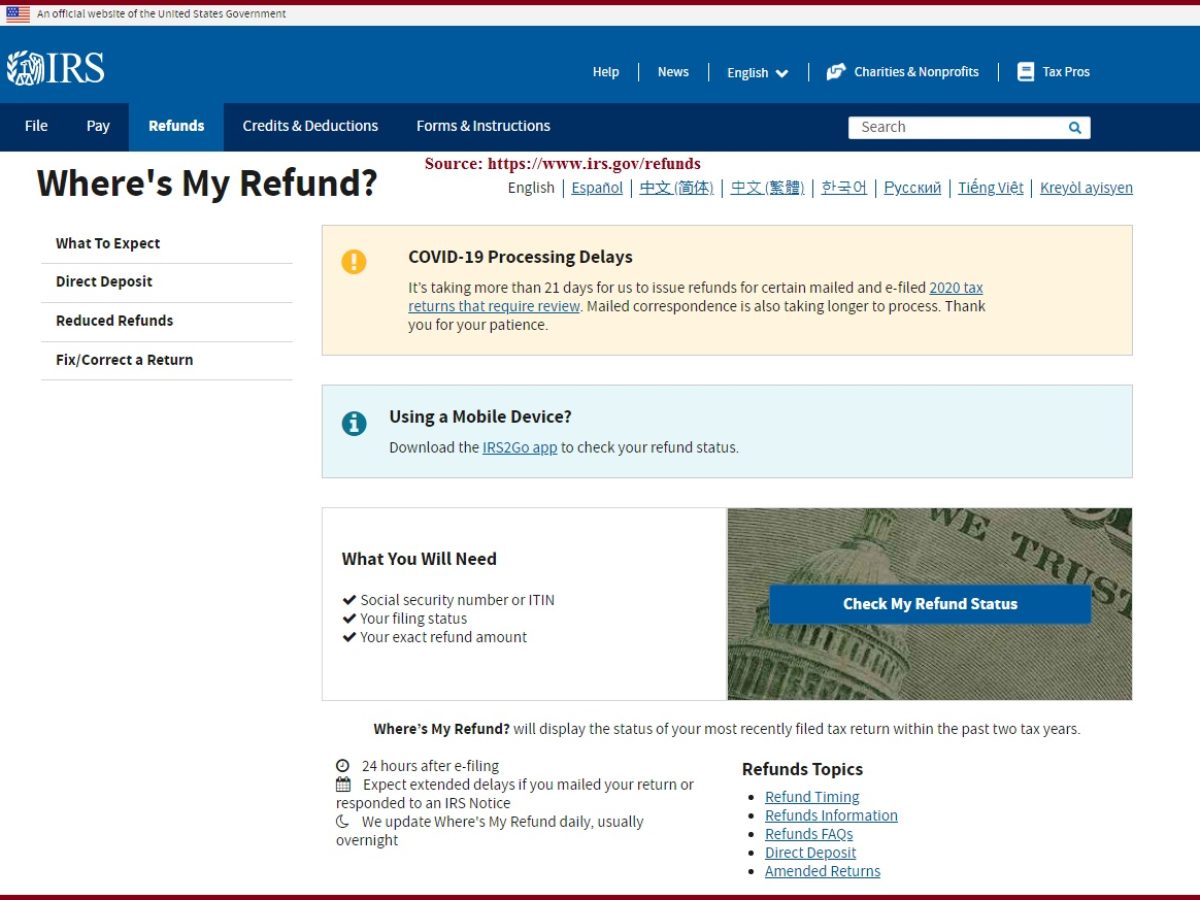

IRS unemployment refund update. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Tax Refund Offsets Where S My Refund Tax News Information

Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

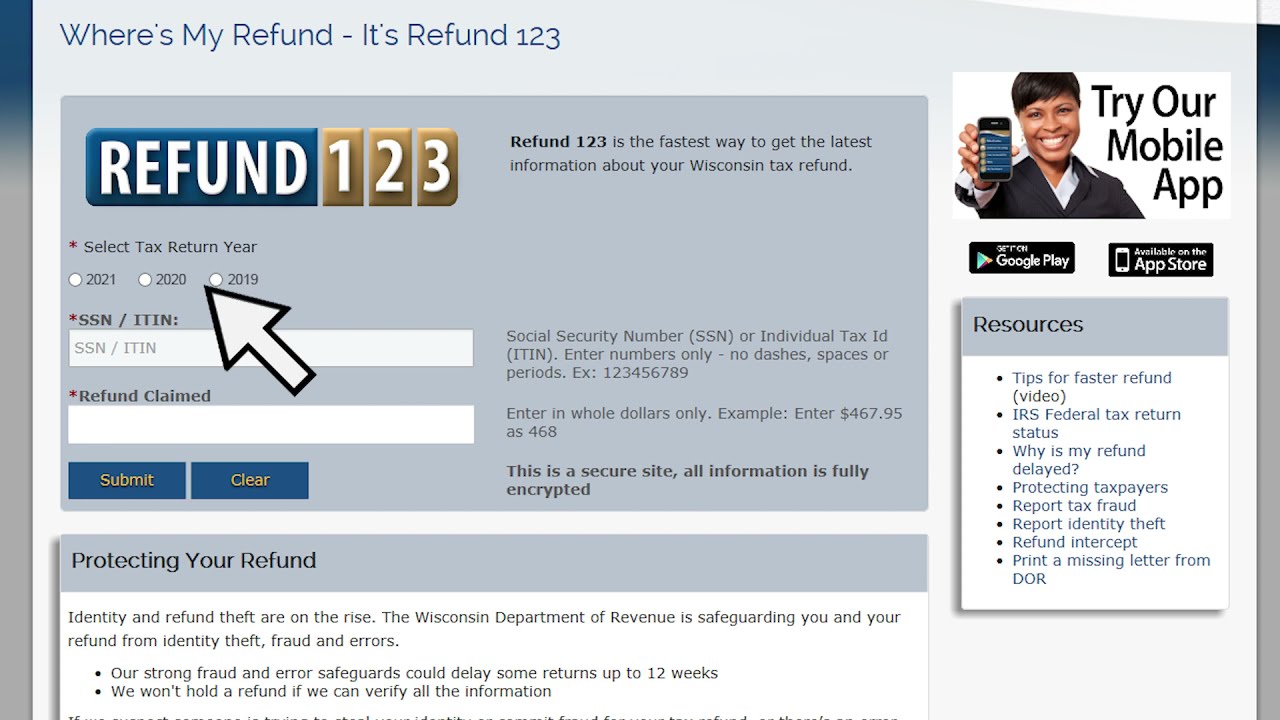

. Get Instant Recommendations From Top Websites. 2021 tax preparation software. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund.

1st Quarter Payroll Tax Return. Online Account allows you to securely access more information about your individual account. Choose the federal tax option and the 2020 Account Transcript.

A current government-issued photo ID. The first way to get clues about your refund is to try the IRS online tracker applications. A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for.

The Wheres My Refund tool can be accessed hereIf you filed an amended return you can check the Amended Return Status tool. Quarterly Estimated Income Tax Payment. How To Track Your Refund And Check Your Tax Transcript.

A man charged with killing a woman found Saturday morning in a Seaside Heights motel was arrested after he overdosed at a nearby motel authorities said. Refund for unemployment tax break. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

Can you track your unemployment tax refund. Quarterly Sales Tax Return for NJ. 100 Free Tax Filing.

Prepare for Your Appointment. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see when it would arrive in your bank account. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

A taxpayer identification number such as a Social Security number. If you see a Refund issued then youll likely see a. Any other documentation you need for your appointment.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. Check My Refund Status. The letters go out within 30 days of a correction.

24 hours after e-filing. Efile your tax return directly to the IRS. Use our COVID-19 Screening Tool to protect yourself and our employees.

There is no tool to track it but you can check your tax transcript with your online account through the IRS. You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal. Prepare federal and state income taxes online.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. Schedule your appointment ahead of time. Viewing your IRS account information.

Bring the following items with you. 4 weeks after you mailed your return. TAX SEASON 2021.

How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million Americans who incorrectly paid. Using the IRS Wheres My Refund tool. 100 free federal filing for everyone.

See How Long It Could Take Your 2021 State Tax Refund. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. See 2022s Top Web Results.

If those tools dont provide information on the status of your unemployment tax refund. Ad File your unemployment tax return free. Ad Top Quality Website Results Ranked By Customer Satisfaction.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. Use Form 1040-ES For US Citizens and Resident Aliens abroad at the time of the April 15 Individual Income Tax Return deadline this is the due date. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

Unemployment Refund Tracker Unemployment Insurance TaxUni. The 10200 is the amount of income exclusion for single filers not the amount of the refund. Quarterly Sales Tax Returns for NY.

Premium federal filing is 100 free with no upgrades for premium taxes. Check For The Latest Updates And Resources Throughout The Tax Season.

10 200 Unemployment Refund Check Status How To Check Your Unemployment Refund With The Irs Youtube

Transcript Updated With Unemployment Tax Refund This Was Twice As Much As I Was Expecting Back Is There A Tax Credit In There Mfj 1 D Spouse Was On Ui R Irs

Unemployment Tax Refund Advice Needed R Irs

Irs Refund Status Unemployment Refund Schedule Is Delayed Marca

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Questions About The Unemployment Tax Refund R Irs

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

The Ui Tax Refund On My Transcript 1 229 23 Is Less Then The Unemployment Taxes Paid 2 606 Shown On My 1099g Is There Any Reason For This R Irs

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Where S My Refund Wisconsin Income Tax Refund Status Youtube

10 200 Unemployment Tax Free Refund Update How To Check Your Refund Date Ca Edd And All States Youtube

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Your Tax Return Is Still Being Processed Irs Where S My Refund 2022

![]()

What To Know About Unemployment Refund Irs Payment Schedule More