pa local services tax deductible

From Deductions contributions select Start or Edit. It is the responsibility of the employer to deduct from.

Local Services Tax York Adams Tax Bureau

For areas under Act 199 deductions will be greater.

. If the total LST rate enacted is 1000. In the past it could be deducted as a. If the total LST rate enacted is 1000.

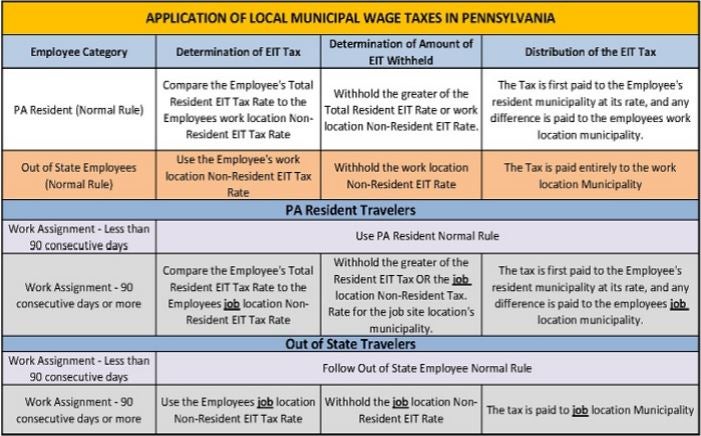

Formerly the Emergency and Municipal Services Tax Pennsylvania Act 7 of 2007 amends the Local Tax Enabling Act Act 511 of 1965 to make the following major changes to the. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local.

Restricted tax credits claimed on Line 23 of the PA-40 Personal Income Tax Return or Line 14 of the PA-41 Fiduciary Income Tax Return are listed on PA-40 Schedule OC. If your municipality charges a local services tax LST you may be wondering if the amount from your W-2 box 14 LST category can be deducted on your federal income taxes. Pennsylvania Local Services Tax.

Ad Well Help You to Connect with Experts in Tax Services Try it Now. DCED Local Government Services Act 32. Thus it is not a deductible local income tax.

Local Income Tax Requirements for Employers. I live in PA. Local Income Tax Information.

Property TaxRent Rebate Status. Turbo tax imported this as Other mandatory deductible state or local tax not listed. The Local Services Tax is imposed upon each individual engaged in any occupation in Middletown Township.

In the Deductions for Benefits section select Add a Deduction. This is listed on my W2 in box 14 as PA LST 52. DCED lacks the legal authority to extend the statutory local filing and payment deadline of April.

Deductions Allowed For Pennsylvania Tax Purposes. The PA Local Services Tax is an employment related tax not based upon income amount. Thus it is not a deductible local income tax.

Set up the PA local services tax. I have an LST or Local Services Tax in box 14. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

The PA Local Services Tax is an employment related tax not based upon income amount. As a result it is not a deductible local income tax. I tracked down the difference to my local services tax LST.

However as a result of the 2017 tax reforms one cannot no. Go to Payroll then Employees. The PA Local Services Tax is an employment related tax not based upon income amount.

The PA Local Services Tax is a tax on employment that is not based on income. Pennsylvania Department of Revenue Im looking for. In tracking it down I found that.

In the past it could be deducted as a. In the past it could be deducted as a. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

LST is also known as the head. In tracking it down I found that my deductions for state and local taxes are off. Thus it is not a deductible local income tax.

The Best Detailed List Of Small Business Tax Deductions Ageras

Act 32 Local Income Tax Psd Codes And Eit Rates

12242 Pa Splitting Tax Between School District And Municipality

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

New Bill Would Restore Tax Deduction For Union Dues Other Worker Expenses

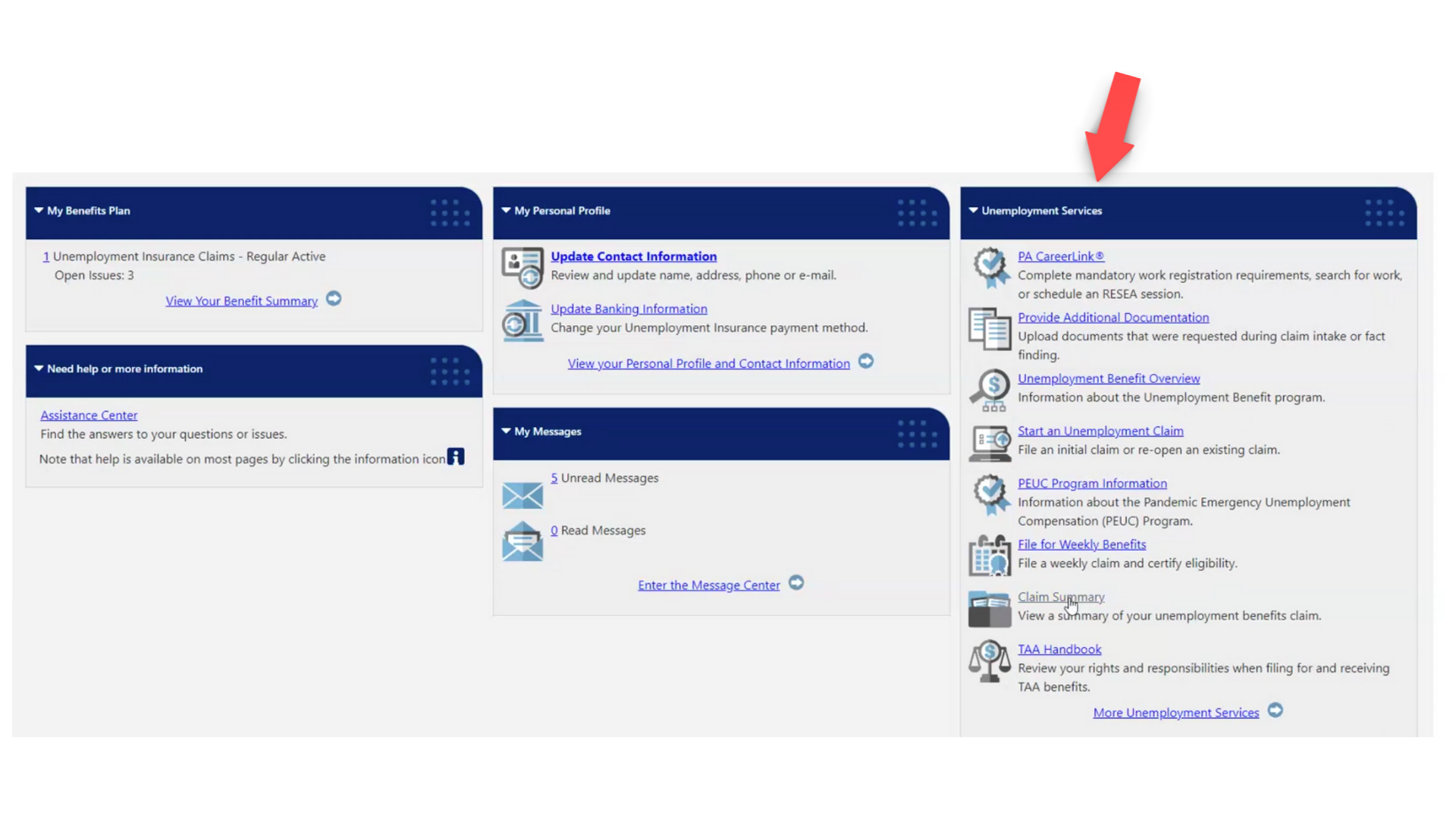

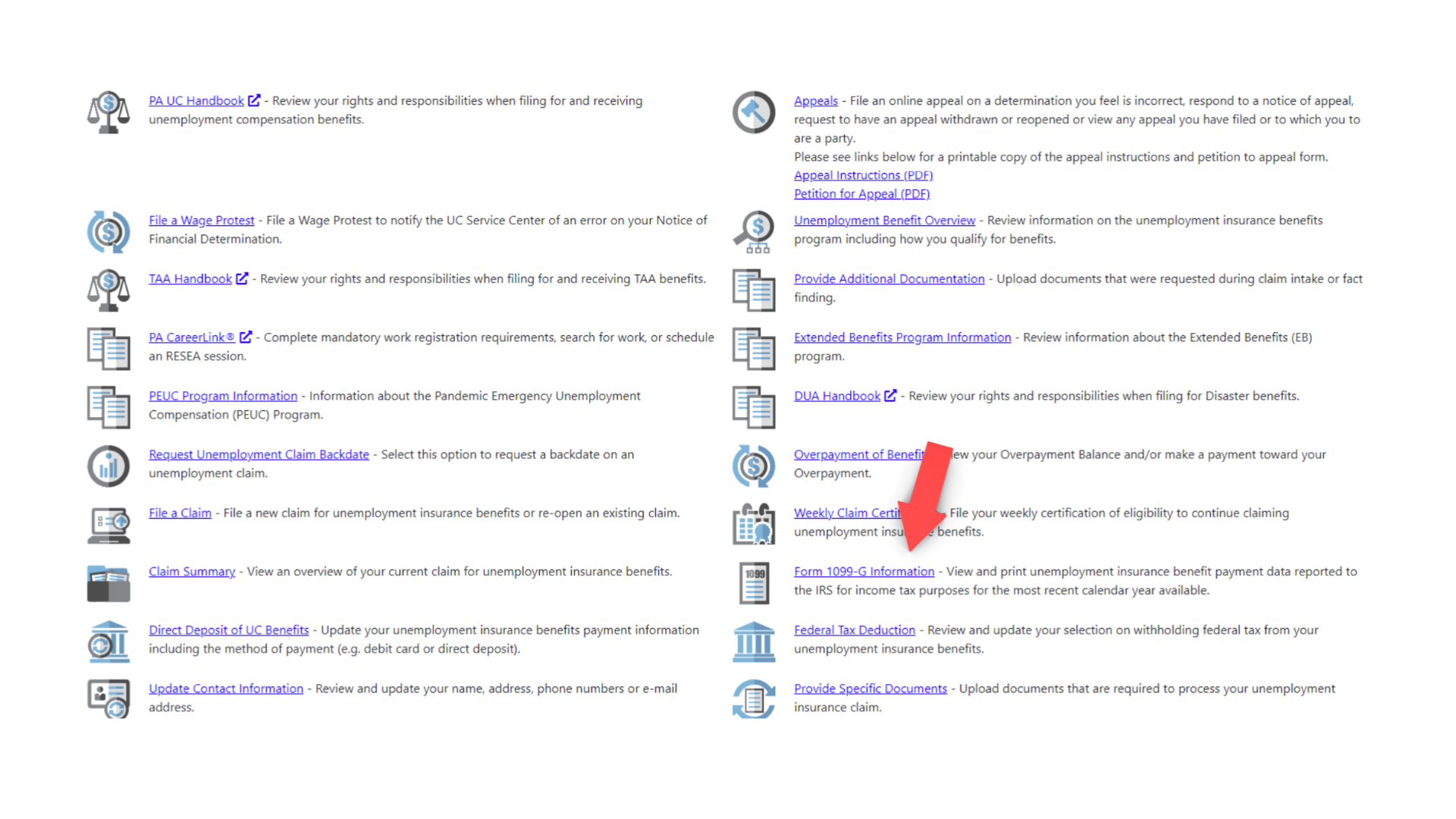

Unemployment Benefits Tax Issues Uchelp Org

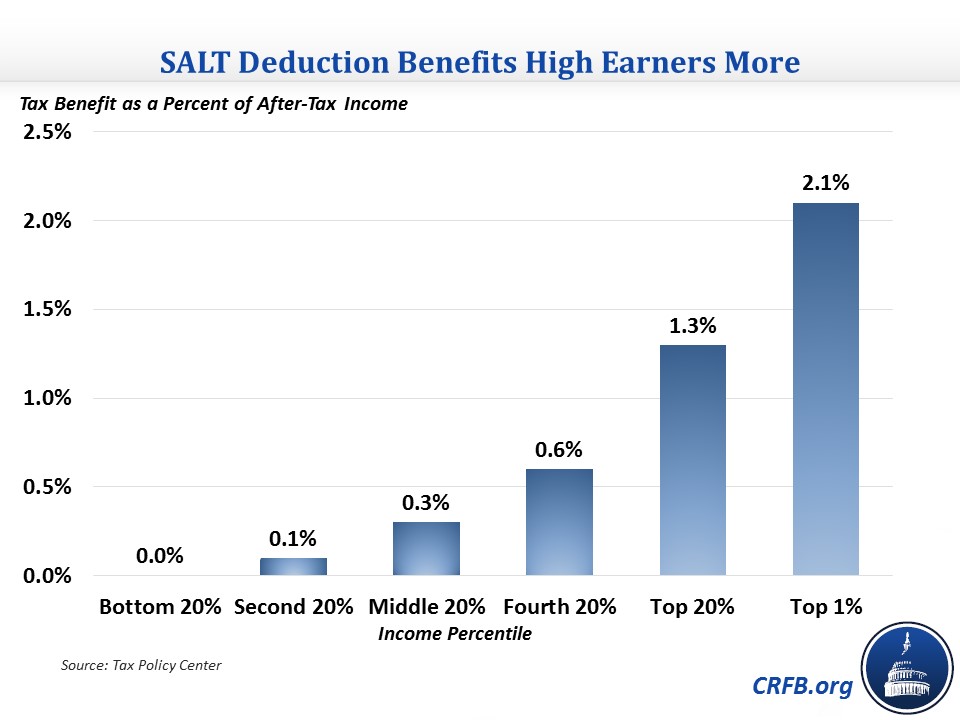

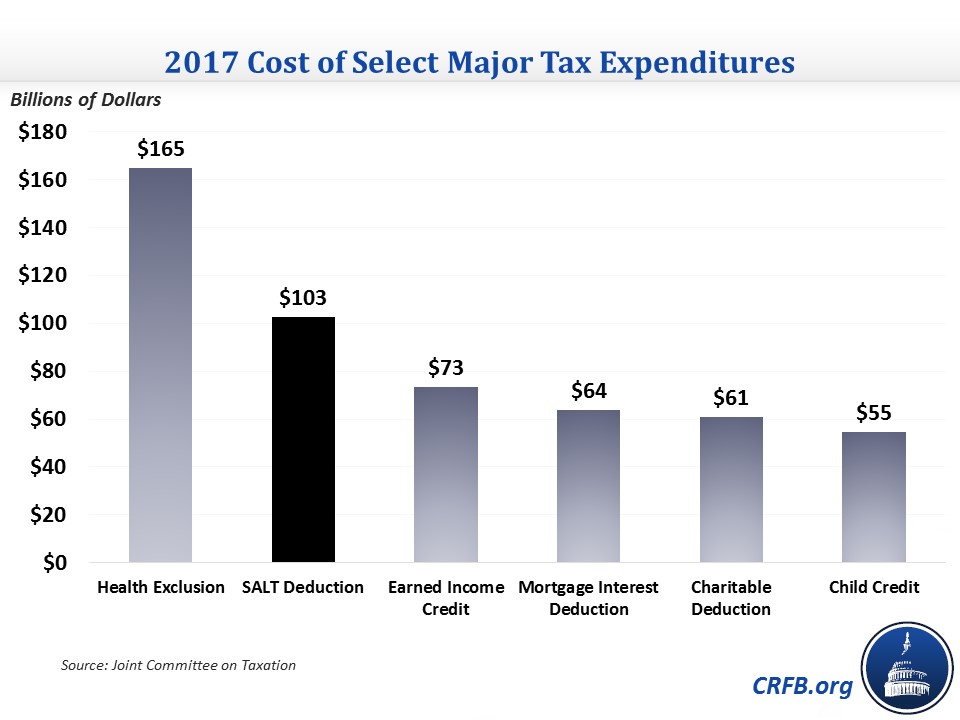

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Local Service Tax City Of Johnstown Pa

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Short Certificate Example Fill Online Printable Fillable Blank Pdffiller

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Pennsylvania Local Services Tax Lst

State And Local Taxes What Is The Salt Deduction

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

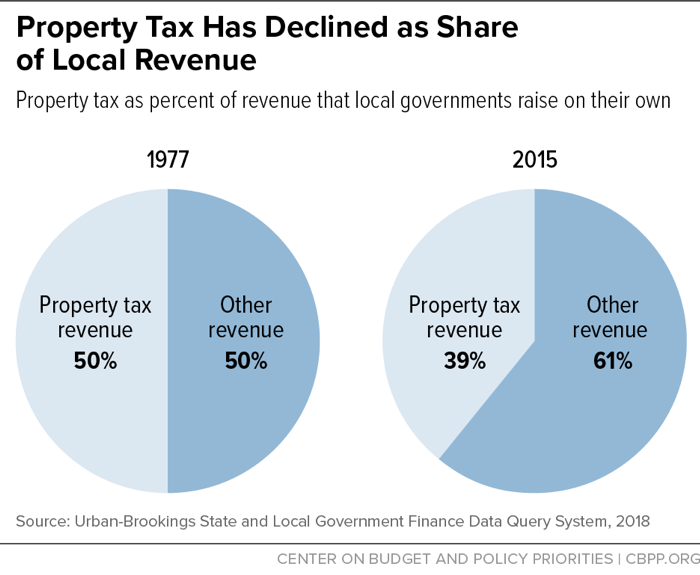

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

State Conformity To Cares Act American Rescue Plan Tax Foundation

Guide To Local Wage Tax Withholding For Pennsylvania Employers